Mileage Reimbursement Form 2024 Usps. 438 pay during travel or training 438.1 pay during travel 438.11 definitions. Whether you're driving for business or moving purposes, understanding the rate per mile set by the general services.

How to calculate mileage reimbursement in 2024. Select the year to be.

Start By Entering The Total Miles Traveled For Business Purposes.

This notice provides the optional 2024 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business,.

Per Irs Instructions For Form 2106 Employee Business Expenses, Page 2:

The amount of expenses you can deduct on schedule 1 (form 1040), line 12, is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the.

If You Were A Rural Mail Carrier, You.

Images References :

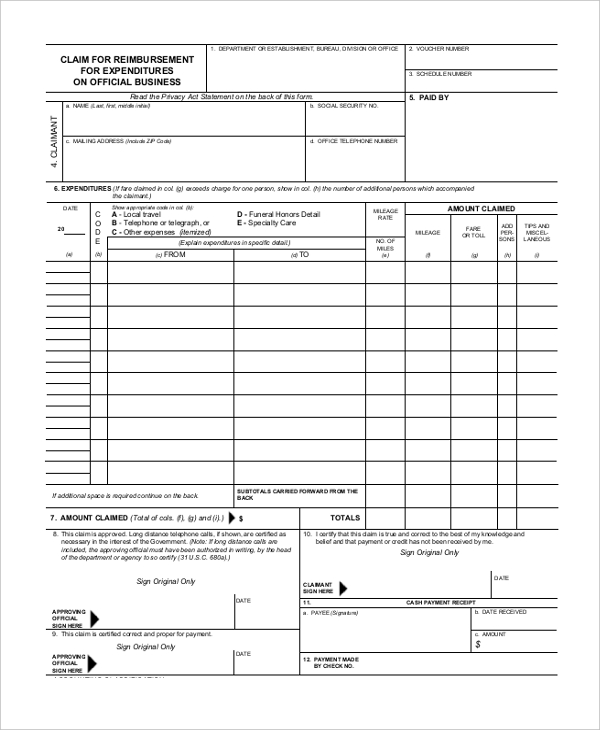

Source: climate-pledge.org

Source: climate-pledge.org

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word eForms, If you were a rural mail carrier, you. Home > staff portal > mileage reimbursement form 2024.

Source: koralleweve.pages.dev

Source: koralleweve.pages.dev

What Is The Mileage Rate For 2024 In California Godiva Ruthie, 438 pay during travel or training 438.1 pay during travel 438.11 definitions. April 18, 2024 1:43 am.

Source: elcacerolazo.org

Source: elcacerolazo.org

Simple Mileage Reimbursement Form Elcacerolazo, Home > staff portal > mileage reimbursement form 2024. 67 cents per mile for business miles driven (including a 30.

Source: www.sampleforms.com

Source: www.sampleforms.com

FREE 9+ Sample Mileage Reimbursement Forms in PDF Word Excel, The irs sets a standard mileage rate each year, which serves as a guideline for employers to calculate mileage. If you were a rural mail carrier, you.

Source: www.moneymakermagazine.com

Source: www.moneymakermagazine.com

Mileage Rate 2024 Top 5 Insane Tax Hacks You Need!, 716.124 spouse traveling in lieu of employee. Per irs instructions for form 2106 employee business expenses, page 2:

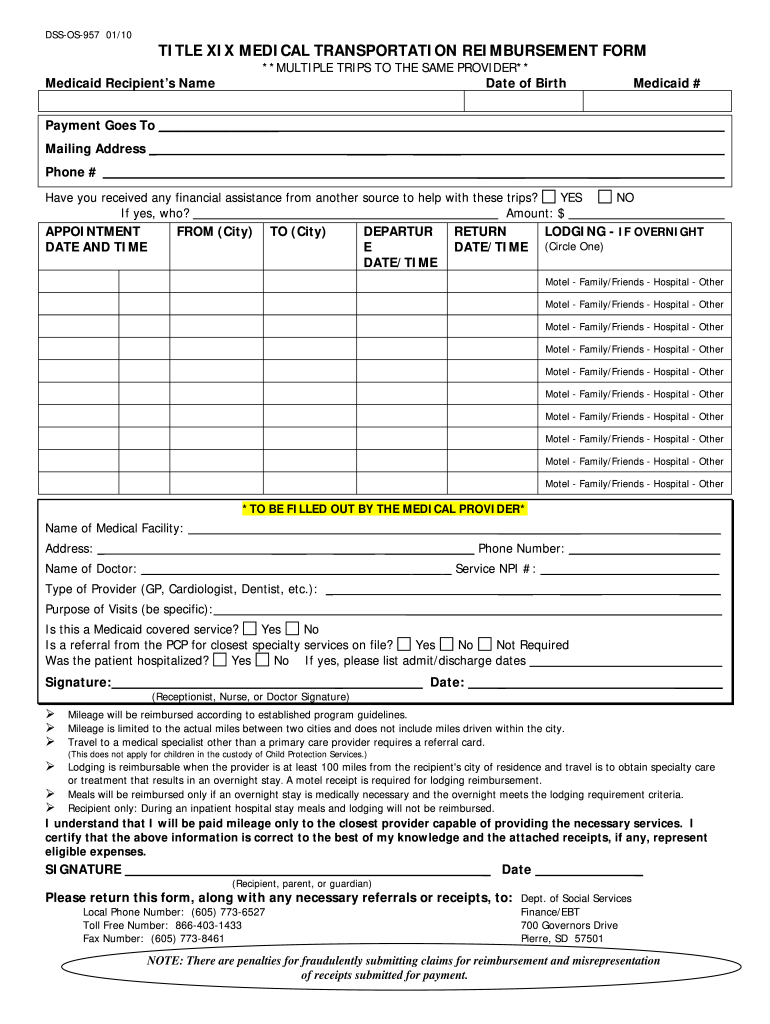

Source: www.dochub.com

Source: www.dochub.com

Medicaid mileage reimbursement form Fill out & sign online DocHub, If you are using your own vehicle for business travel, you can claim mileage but you can’t be reimbursed for buying fuel. 1, 2024, the standard mileage rate will be 67 cents per mile for business use, up 1.5 cents from 2023.

Source: jhwlawoffice.com

Source: jhwlawoffice.com

Mileage Reimbursement Workers' Compensation Attorney Work Accident, 1, the 2024 mileage reimbursement rates for the use of a car (or a van, pickup or panel truck) are: Here are the mileage rates for the year 2024:

Source: www.youtube.com

Source: www.youtube.com

🔴 Mileage Reimbursement Rate for 2023 What To Expect SSI SSDI, Here are the mileage rates for the year 2024: 1, the 2024 mileage reimbursement rates for the use of a car (or a van, pickup or panel truck) are:

Source: bestyload672.weebly.com

Source: bestyload672.weebly.com

Mileage Tracking Form Log Template Excel Tracker Sheet And bestyload, Travel time — time spent by. Whether you're driving for business or moving purposes, understanding the rate per mile set by the general services.

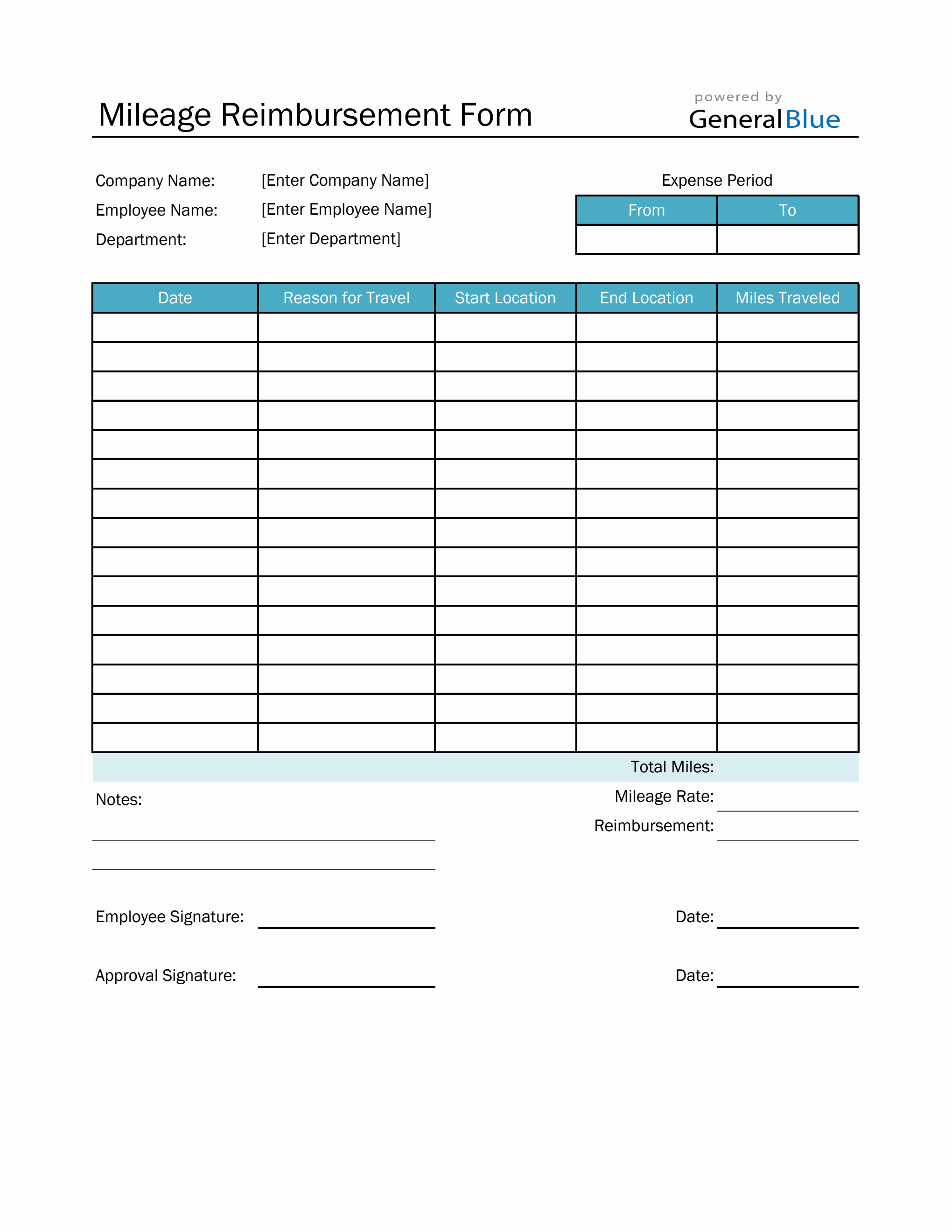

Source: www.generalblue.com

Source: www.generalblue.com

Mileage Reimbursement Form in Excel (Basic), This notice provides the optional 2024 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business,. 1, the 2024 mileage reimbursement rates for the use of a car (or a van, pickup or panel truck) are:

27, 2023 At 9:20 A.m.

The irs sets a standard mileage rate each year, which serves as a guideline for employers to calculate mileage.

The General Services Agency (Gsa) Has Released New Rates For Reimbursement Of Privately Owned Vehicle (Pov) Mileage For 2024.

Mileage reimbursement is when a company reimburses an employee who used their personal vehicle (car, van, truck, etc.) for business use.