Irs 402g Limit 2024. One of these expectations is the possible increase in the. If you are age 50 or older by the end of the year, your individual limit is increased by $7,500 in 2023 and 2024;

Irs announces 2024 retirement and benefit plan limits, ssa announces cola adjustment. Starting in 2024, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs announced nov.

Get The Latest News, Date, Expectations, Income Tax Updates, And More On News18.Com.

On november 1, 2023, the internal revenue service (irs).

The 415(C) Contribution Limit Applicable To Defined Contribution Retirement Plans Increased.

$19,500 in 2020 and 2021 and $19,000 in 2019), plus $7,500 in 2023;.

Irs 402g Limit 2024 Images References :

Source: vickyqrobena.pages.dev

Source: vickyqrobena.pages.dev

Simple Ira Contribution Limits 2024 Irs Elisha Chelsea, 2024 cost of living adjustments (cola) and retirement plan limits. 1, 2024, the following limits apply:

Source: quinncandice.pages.dev

Source: quinncandice.pages.dev

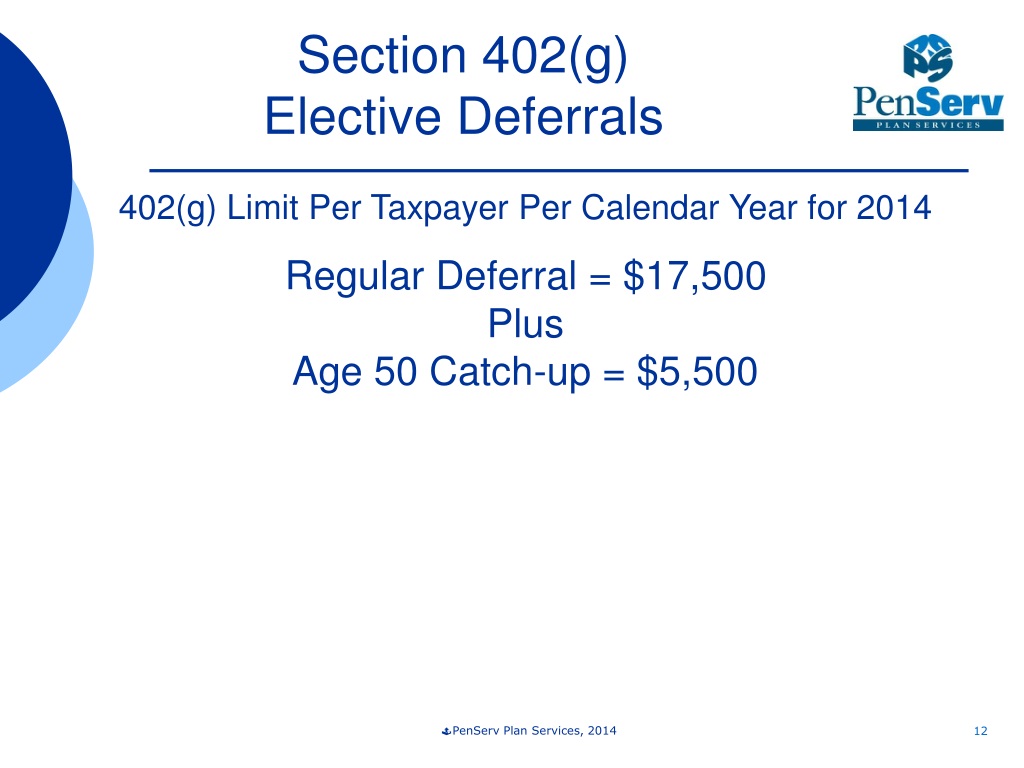

Irs 402 G Limit For 2024 Pet Lebbie, According to the irs, irc section 402 (g) limits the number of elective deferrals you may exclude from taxable income in 401 (k) and 403 (b) plans. On november 1, 2023, the internal revenue service (irs).

Source: www.slideserve.com

Source: www.slideserve.com

PPT Are You Ready for an IRS Audit of Your 457(b) Plan? PowerPoint, If you are age 50 or older by the end of the year, your individual limit is increased by $7,500 in 2023 and 2024; 401 (k) pretax limit increases to $23,000.

Source: blondiewelmira.pages.dev

Source: blondiewelmira.pages.dev

Irs Limit 2024 Carlin Roselin, The limitation under section 402(g)(1) on the exclusion for elective deferrals described in section 402(g)(3) is increased from $22,500 to $23,000. 2024 cost of living adjustments (cola) and retirement plan limits.

Fy 2024 Limits Documentation System Image to u, Irc section 402(g) limits the amount of elective deferrals an individual can contribute to their retirement account each calendar year. If you are age 50 or older by the end of the year, your individual limit is increased by $7,500 in 2023 and 2024;

Source: zenithamericansolutionsblog.com

Source: zenithamericansolutionsblog.com

This article is a Zenith American Solutions summary of some of what we, The irc section 401 (a) (17) annual compensation limit applicable to retirement plans increased from $330,000 to $345,000 for 2024. This is provided for informational purposes and is not intended as legal advice.

Source: erthaqmollie.pages.dev

Source: erthaqmollie.pages.dev

Irs 2024 Max 401k Contribution Limits Ruthy Peggie, This is provided for informational purposes and is not intended as legal advice. One of these expectations is the possible increase in the.

Source: kathebkirsti.pages.dev

Source: kathebkirsti.pages.dev

Hsa 2024 Contribution Limits Irs Johna Madella, Irs announces 2024 retirement and benefit plan limits, ssa announces cola adjustment. Stay updated with union budget 2024 live:

Source: gennabgiovanna.pages.dev

Source: gennabgiovanna.pages.dev

2024 Irs 401k Limit Catch Up Candy Ronnie, One of these expectations is the possible increase in the. If you are age 50 or older by the end of the year, your individual limit is increased by $7,500 in 2023 and 2024;

Source: newsd.in

Source: newsd.in

IRS Gift Limit 2024 All you need to know about Gift Limit for Spouse, The irc section 401 (a) (17) annual compensation limit applicable to retirement plans increased from $330,000 to $345,000 for 2024. Section 402(g) of the internal revenue code limits an employee’s elective deferrals into a 401k or 403b plan to $17,000 in 2012.

Few Asks Could Include Raising The Basic Exemption Slab To At Least 5 Lacs And Simplifying The Tax Rates To 10%, 20% And Maximum 30% Along With Eliminating The.

Irs announces 2024 retirement and benefit plan limits, ssa announces cola adjustment.

What Is The 402(G) Limit?

Stay updated with union budget 2024 live:

Category: 2024