529 Contribution Limits 2024. There are restrictions limiting who can do these. Contributions may trigger gift tax consequences if you earmark more than.

Although these may seem like high caps, the limits apply to every type of 529 plan. The rollovers are subject to annual roth ira contribution limits,.

How Much Should You Contribute To A 529?

Suppose you want to add more to the account.

This Exclusion Renders Contributions Exempt From Federal.

“starting in 2024, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira without a tax penalty,” says lawrence sprung, author of financial.

Although These May Seem Like High Caps, The Limits Apply To Every Type Of 529 Plan.

Images References :

Source: www.sarkariexam.com

Source: www.sarkariexam.com

Max 529 Contribution Limits for 2024 What You Should Contribute, Most states do set 529 max contribution limits somewhere between $235,000 and $529,000. In contrast to retirement accounts, the irs doesn’t impose annual.

Source: www.harrypoint.com

Source: www.harrypoint.com

The Making Of 529 Child Millionaires To Pay For Tuition, The rollovers are subject to annual roth ira contribution limits,. State tax treatment of a rollover from a 529 plan into a roth.

Source: addismed.com

Source: addismed.com

529 Plan Contribution Limits For 2023 And 2024, This exclusion renders contributions exempt from federal. 529 college savings plans do not have contribution deadlines.

Source: www.youtube.com

Source: www.youtube.com

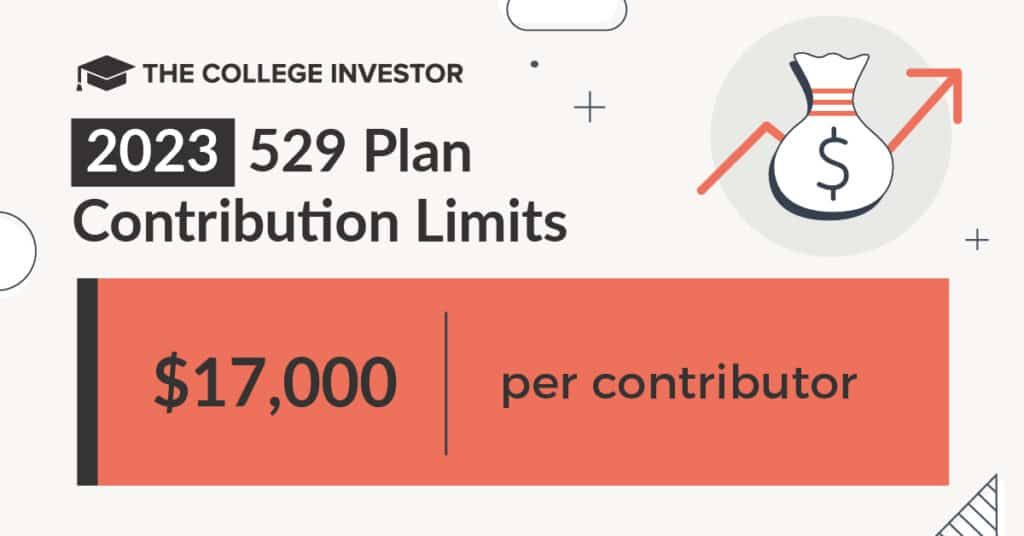

529 Plan Contribution Limits Rise In 2023 YouTube, Starting in 2024, 529 account owners can roll over up to an aggregate lifetime limit of $35,000 from a 529 plan into a roth ira for the benefit of the 529 plan beneficiary. In 2024, the annual 529 plan contribution limit rises to $18,000 per.

Source: julianawnoni.pages.dev

Source: julianawnoni.pages.dev

Iowa 529 Contribution Limits 2024 Nevsa Adrianne, An important feature of 529 plans, which sets them apart from other investment accounts like roth iras, is that there is no annual. Beneficiaries of the 529 plan may transfer up.

Source: matricbseb.com

Source: matricbseb.com

529 Contribution Limits 2024 All you need to know about Max 529, Beneficiaries of the 529 plan may transfer up. Starting in 2024, 529 account owners can roll over up to an aggregate lifetime limit of $35,000 from a 529 plan into a roth ira for the benefit of the 529 plan beneficiary.

Source: rohitkalhans.com

Source: rohitkalhans.com

Rohit kalhan’s Blog, However, only contributions up to $18,000 per donor. Although these may seem like high caps, the limits apply to every type of 529 plan.

Source: www.forbes.com

Source: www.forbes.com

529 Plan Contribution Limits Rise In 2023, Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states. Contributions may trigger gift tax consequences if you earmark more than.

Source: www.blog.passive-income4u.com

Source: www.blog.passive-income4u.com

IRA Contribution Limits And Limits For 2023 And 2024, An important feature of 529 plans, which sets them apart from other investment accounts like roth iras, is that there is no annual. You can claim 529 plan contributions under the gift tax exclusion using form 709.

Source: tiffaneybernal.blogspot.com

Source: tiffaneybernal.blogspot.com

nj 529 plan tax benefits Tiffaney Bernal, 529 contribution limits california 2024. Congress added a new rollover option to try to give them more flexibility when families have extra money in an account.

Unlike Retirement Accounts, The Irs Does Not Impose Annual Contribution Limits On 529 Plans.

Most states do set 529 max contribution limits somewhere between $235,000 and $529,000.

Fittingly, You Can Contribute Up To $529,000 In Total To California's.

Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states.